Understanding Insurance and Vehicle Logistics

Before diving into the specifics of how CAAS integrates into the claims and assessment processes, it’s essential to first understand the basics of insurance and its role in vehicle logistics. Below are key concepts that lay the foundation for understanding how insurance impacts the vehicle lifecycle.

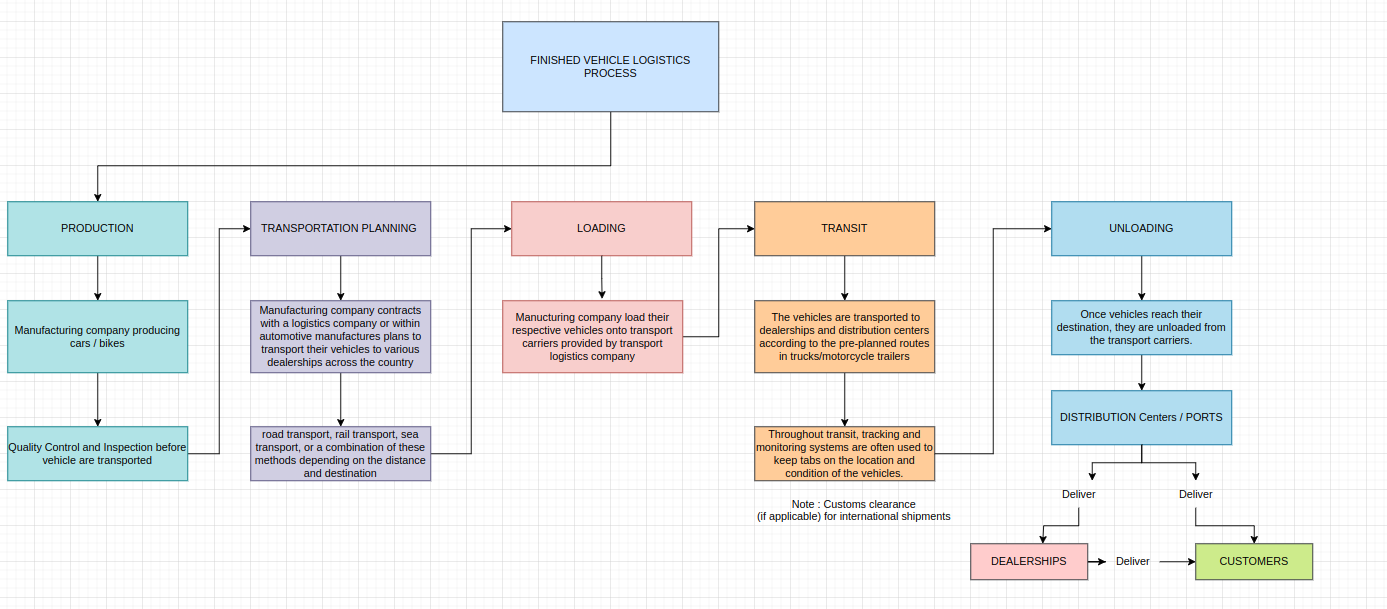

Finished Vehicle Logistics Process

Finished vehicle logistics involves several steps to ensure vehicles are efficiently and safely transported to their final destination. Here’s an overview:

1. Overview of Finished Vehicle Logistics

- Production: The process begins at the manufacturing plant where vehicles are produced and prepared for transport.

- Quality Control and Inspection: Vehicles undergo quality control to ensure safety and quality standards before shipment.

- Transportation Planning: Logistics companies or automotive manufacturers plan optimal routes and transportation modes, which may include road, rail, sea, or combined transport methods.

- Loading: Vehicles are loaded onto transport carriers (e.g., car haulers, railcars, or ships) carefully to prevent transit damage.

- Transit: Vehicles are transported to their destination, often with tracking and monitoring systems in place to track their condition and location.

- Customs Clearance (if applicable): For international shipments, vehicles may undergo customs clearance, involving documentation, inspections, and duty or tax payments.

- Unloading: At their destination, vehicles are unloaded carefully from the transport carriers to avoid damage.

- Distribution: Vehicles move from distribution centers or ports to dealerships or directly to customers.

- Delivery to Customers: Direct deliveries are arranged to a specified location, often coordinating a convenient time with the customer.

- Documentation and Handover: Upon delivery, paperwork like invoices, titles, and registration documents is completed, and vehicles are handed over.

Throughout the entire logistics process, efficient coordination, communication, and management are crucial to ensure timely, undamaged delivery. Delays or damage can lead to additional costs and customer dissatisfaction, prompting automotive manufacturers to work closely with logistics providers to optimize the process.

What is Insurance?

Insurance is a contract between an individual or business and an insurance provider, where the insurer agrees to provide financial protection or reimbursement for specified losses or damages. In the context of vehicles, insurance typically covers damages caused by accidents, theft, natural disasters, and other unforeseen events, depending on the policy.

Why is Insurance Important?

- Financial Protection: Insurance provides financial relief when an unexpected event occurs, helping cover repair or replacement costs, which reduces the financial burden on the vehicle owner.

- Legal Requirement: In many regions, vehicle insurance is mandatory by law, ensuring that owners can cover the costs of any damage or injury caused in an accident.

- Peace of Mind: Insurance offers security and peace of mind to vehicle owners, knowing they are protected against unforeseen damages or losses.

When is Insurance Claimed?

Insurance claims can be made at various stages of a vehicle’s lifecycle. Common scenarios for filing claims include:

- Post-Accident: After an accident, the owner files a claim to cover repair or replacement costs.

- Vehicle Delivery & Finished Vehicle Logistics: Logistics companies may file claims if vehicles are damaged in transit.

- Break-In or Policy Lapse: Policyholders may need to file claims after renewal for new damages, though pre-existing ones may not be covered.

- Natural Disasters or Theft: Claims cover losses from natural disasters (e.g., floods, storms) or theft.

- Maintenance-Related Claims in Aftermarket Services: Damages identified during maintenance may also be claimed under specific policies.

Role of Insurance Providers

Insurance companies manage risks and provide financial protection against potential losses in exchange for regular premium payments. Their role involves:

- Underwriting: Assessing the risk associated with insuring a vehicle, including factors like driving history, location, and coverage type, to determine coverage and premium rates.

- Premium Collection: Regularly collected fees that contribute to the insurer's revenue.

- Risk Pooling: Premiums are pooled from multiple policyholders to fund claim payments, diversifying and stabilizing the financial impact of claims.

- Claims Processing: Validating and determining the extent of coverage when a claim is filed.

- Payout: If approved, the insurer covers the policyholder's losses up to policy limits.

- Regulatory Compliance: Insurers must comply with regulations, including maintaining reserves for claims and transparency with policyholders.

Example: Insurance providers in vehicle logistics include SBI, Royal Sundaram, and HDFC ERGO.

Insurance Categories

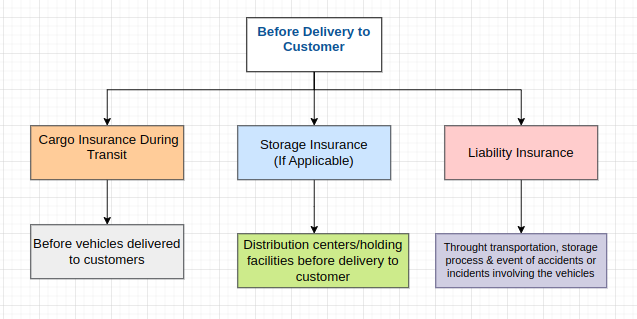

Before Vehicle Delivery to Customer

1. Cargo Insurance During Transit

During the transit period from manufacturing plants to distribution centers or dealerships, cargo insurance provides coverage against loss or damage to the vehicles. This insurance is often provided by the carrier or logistics provider responsible for transportation, protecting against risks such as:

- Accidents

- Theft

- Fire

- Natural disasters

Additionally, automotive manufacturers or dealerships may purchase supplemental insurance to safeguard their interests during transit.

2. Storage Insurance (if applicable)

If vehicles are held at distribution centers or storage facilities before reaching customers, storage insurance covers potential loss or damage while the vehicles are in storage. This insurance protects against:

- Theft

- Vandalism

- Fire

- Environmental damage

3. Liability Insurance

Liability insurance remains active throughout the transportation and storage stages, covering insured parties like carriers, logistics providers, and dealerships. It provides protection against claims related to:

- Property damage

- Bodily injury

- Legal expenses and compensation for accidents or incidents involving the vehicles

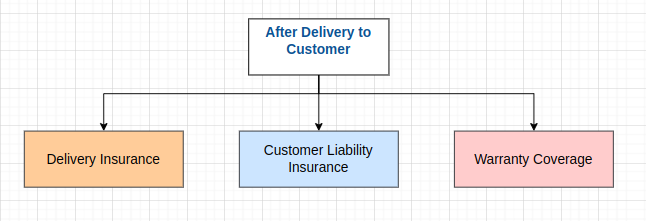

After Vehicle Delivery to Customer

1. Delivery Insurance

After vehicles are delivered, they may still be covered by delivery insurance for a specified period or until the customer takes full possession. This insurance protects against damages that could occur during the final delivery process, including:

- Loading

- Unloading

Delivery insurance ensures that vehicles are adequately protected until they are officially handed over to the customers.

2. Customer Liability Insurance

Customers may have the option to purchase liability insurance to protect their vehicles against risks such as:

- Accidents

- Theft

- Vandalism

- Damage from natural disasters

Customer liability insurance offers peace of mind by covering repair or replacement costs in case of unforeseen events that damage their vehicles.

3. Warranty Coverage

While not strictly insurance, warranty coverage provided by automotive manufacturers or dealerships may also be active post-delivery. Warranty coverage typically protects against defects in materials or workmanship for a specified period or mileage, providing additional assurance regarding the quality and reliability of the vehicles.

Throughout these stages, insurance plays a crucial role in mitigating risks and providing financial protection to all parties involved in finished vehicle logistics, from manufacturing to delivery to customers.

Vehicle Insurance Claim Process

The owner of the vehicle can initiate a claim with their insurance provider. Here’s a typical step-by-step process for customers to follow.

Claim Process

- Notification of Loss or Damage: Notify the insurance provider promptly after the incident via their claims hotline or by contacting an agent directly. Timely notification helps with efficient processing.

- Provide Details of the Incident: Customers must supply specifics, including:

- Date, time, and location of the incident

- Description of how the incident occurred

- Additional documentation, like police reports or witness statements

- Documentation: The insurer may require supporting documents, such as:

- Proof of ownership (e.g., registration or purchase agreements)

- Photos or videos of the damage

- Repair estimates from authorized facilities

- Claim Submission: Submit the claim with all necessary documentation, using methods like online forms, email, or insurer-provided forms.

- Claim Processing: The insurer reviews the claim, possibly conducting an investigation and checking coverage against policy terms.

- Claim Evaluation: The insurance company evaluates the claim details. Approved claims proceed to settlement, while denied claims may be appealed.

- Claim Settlement: Approved claims receive compensation based on:

- Extent of damage

- Repair costs

- Policy deductibles and limits

- Resolution: With the compensation, the customer can proceed with repairs or other necessary actions.

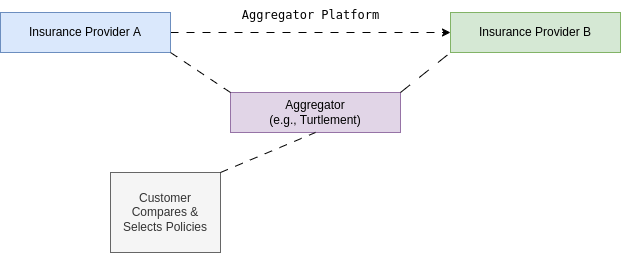

Insurance Aggregators

Insurance aggregators, such as Turtlemint, simplify the process of shopping for insurance by allowing users to compare policies from various providers on a single platform. This makes it easier for customers to find the right coverage at the best price, without needing to visit multiple providers individually.

Key Features

- Comparison Platform: Aggregators offer a centralized platform for users to view and compare policies from different providers.

- Facilitator Role: Aggregators connect customers with insurance providers, simplifying the shopping experience without underwriting policies.

- No Risk Assessment: Unlike brokers, aggregators don’t perform risk assessments; this remains solely with the insurance providers.

Benefits

- Convenience: Customers can easily compare policies without visiting multiple provider sites or contacting agents individually.

- Transparent Pricing: Aggregators often display transparent pricing and benefits, helping users make informed choices.

- Better Coverage Selection: Comparisons help customers identify policies that best meet their coverage needs and budget.

Limitations

- No Personalized Risk Evaluation: Aggregators do not provide personalized risk assessments; customers need to consult providers for underwriting details.

- Not All Policies Available: Some insurance providers may not participate on all aggregator platforms, potentially limiting options.

Process Overview

- Customer: Begins the process by seeking insurance coverage on the aggregator platform.

- Aggregator Platform: The platform provides a comparison of policies from different providers.

- Policy Comparison: Customers compare policies based on coverage, premiums, and other features.

- Selection: The customer selects a policy that best matches their needs and preferences.

- Direct Connection: The aggregator connects the customer directly with the chosen provider.

- Application Process: The customer completes the application with the provider, often aided by the aggregator.

This overview shows how aggregators simplify policy selection, enabling customers to compare and connect with insurance providers efficiently.

Insurance Brokers

Insurance brokers, such as QuickInsure and RenewBuy, serve as intermediaries between insurance companies and customers, providing personalized services to help clients navigate the insurance landscape and find policies that meet their specific needs.

Key Features

- Intermediary Role: Brokers act as middlemen, facilitating communication between customers and insurance providers. They help clients understand their options and make informed choices.

- Personalized Advice: Brokers offer tailored advice based on customer needs, recommending policies that consider coverage, costs, and risks.

Functions

- Risk Assessment: Brokers assess the customer's situation to recommend suitable coverage, helping clients understand necessary protections.

- Claim Processing: Brokers assist customers in filing claims, guiding them through necessary documentation to expedite the process.

- No Payout Authority: Unlike insurers, brokers cannot pay claims; they facilitate the customer-insurance provider relationship for smooth processing.

Benefits

- Expert Guidance: Customers benefit from brokers' insurance market knowledge and insights into the best policies.

- Time Savings: Brokers research and compare policies, saving clients time and effort.

- Access to Multiple Providers: Brokers often work with multiple insurers, offering clients a wider range of options and competitive pricing.

Limitations

- Commission-Based: Brokers earn commissions from insurers, which may influence their recommendations.

- Dependent on Providers: A broker’s effectiveness depends on their relationships with providers and the range of available products.

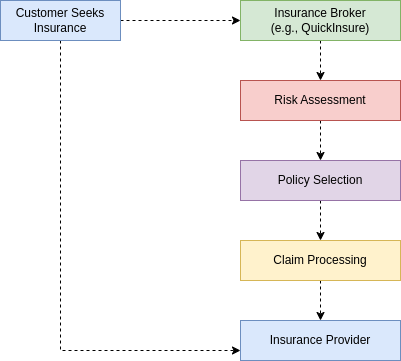

Process Overview

- Customer: Begins the process by seeking insurance with specific coverage needs.

- Insurance Broker: The customer connects with a broker (e.g., QuickInsure), who offers personalized guidance and support.

- Risk Assessment: The broker evaluates customer needs and risks to recommend appropriate coverage.

- Policy Selection: Based on risk assessment, the broker presents suitable policy options, explaining terms and benefits.

- Claim Processing: If needed, the broker assists with claim submission and documentation.

- Insurance Provider: While brokers coordinate with providers, they don’t handle payouts themselves.

This overview illustrates the interaction flow among customers, brokers, and providers, highlighting the broker's role in risk assessment, policy selection, and claim processing.

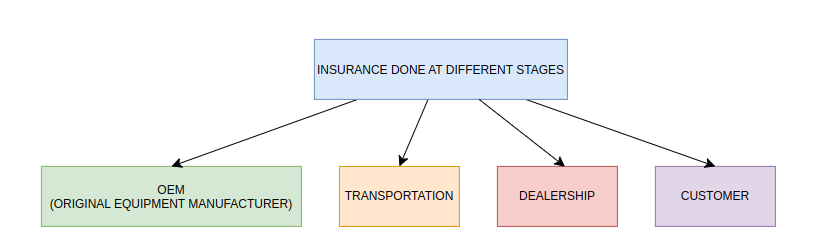

Insurance Stages in Finished Vehicle Logistics

OEM (Original Equipment Manufacturer)

OEM in insurance stands for Original Equipment Manufacturer. It means your insurance policy covers the cost of using brand-new parts from the original manufacturer for repairs, rather than aftermarket parts.

Insurance in Transportation

Insurance in transportation refers to the various types of coverage designed to protect vehicles, cargo, passengers, and businesses involved in the transportation industry. This coverage can include:

Commercial Auto Insurance

Protects vehicles used for business purposes, such as delivery trucks, taxis, and commercial vans, from accidents, theft, and other damages.

Cargo Insurance

Covers the goods being transported against damage, loss, or theft while in transit.

Passenger Liability Insurance

Provides coverage for bodily injury or property damage that passengers may suffer while using transportation services such as taxis, buses, or rideshare vehicles.

Freight Insurance

Similar to cargo insurance, this type of coverage protects the freight or goods being transported, often for larger shipments or specialized cargo.

General Liability Insurance

Offers protection against claims of bodily injury, property damage, and advertising injury that may occur during transportation-related activities.

Workers' Compensation Insurance

Covers medical expenses and lost wages for employees who are injured on the job while working in the transportation industry.

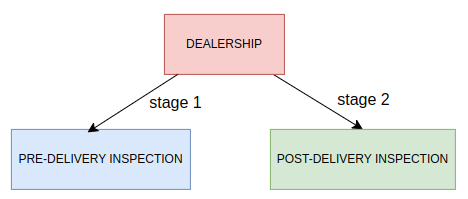

Insurance at Dealership

Insurance at a dealership typically involves two main stages: pre-delivery inspection and coverage after handover.

Pre-Delivery Inspection (PDI)

This covers vehicles while they are still in the dealership's possession and undergoing pre-delivery inspection. It protects against any damage that may occur during this stage, including accidents, theft, or other unforeseen events. PDI insurance ensures that vehicles are in optimal condition before being handed over to customers.

Post-Delivery Inspection

Once vehicles are handed over to customers or moved to another location, the dealership's insurance coverage may change. At this stage, the vehicles might be covered under the dealership's general insurance policy, which typically includes protection against theft, damage, liability, and other risks associated with operating a dealership.

Example: If the vehicles are transported to a port or another storage facility after handover, they may be covered by the dealership's insurance during transit and while in storage until they are sold or otherwise dealt with.

Importance of Dealership Insurance

Insurance at a dealership is essential to protect the dealership's assets, including vehicles, property, and liability exposures, throughout various stages of operation, from inventory management to customer transactions.

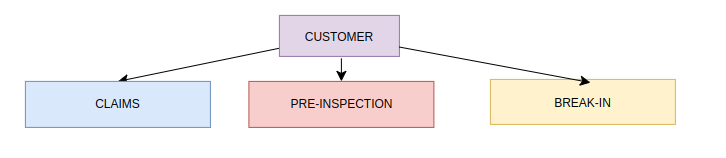

Insurance at Customer End (After Vehicle Purchase)

After purchasing a vehicle, customers typically engage in several insurance-related activities.

Claims Process

Vehicle owners hold insurance policies that cover repair or replacement costs if their vehicle is damaged or involved in an accident. The claims process begins when the owner files a claim.

Pre-Inspection (PI)

Before purchasing or renewing a policy, a vehicle may undergo a pre-inspection to assess its condition. Insurance coverage only applies to undamaged parts, while pre-existing damages are excluded.

Example: If a front bumper dent is found during PI, the insurance will exclude it from coverage.

Break-In Coverage

When renewing a lapsed policy, a break-in inspection is conducted. Coverage applies only to undamaged parts, and pre-existing damages are excluded from the new or renewed policy.

Example: If a windshield crack is found during break-in, it will not be covered in the renewed policy.